Reducing Misrepresentation in Life Insurance

Improving disclosure accuracy through clarity, trust, and thoughtful UX

Misrepresentation is a major cost driver in life insurance. I led an initiative to identify high-risk disclosure patterns, reduce unintentional misreporting, and increase data accuracy without adding friction. Through research, workflow mapping, and iterative experimentation, I created a scalable framework that improved applicant clarity, strengthened underwriting precision, and reduced long-term slippage risk.

Introduction

Life insurance applications require detailed health and lifestyle disclosures. Even minor misunderstandings can create misrepresentation-driving pricing inaccuracy, higher underwriting cost, and downstream operational risk.

This case study covers how I partnered across underwriting, compliance, data science, and engineering to reduce misrepresentation while increasing user trust and conversion.

The Challenge

- Misrepresentation drove significant downstream cost and a rising slippage trend.

- Most inaccuracies were unintentional, caused by unclear wording or ambiguous inputs.

- Existing flows added friction but didn't improve accuracy or truthfulness.

My Role

I led research, cross-functional alignment, UX strategy, and prototyping. I also defined scalable patterns adaptable to all high-risk categories.

Phase 1 - Study

Identifying the Problem

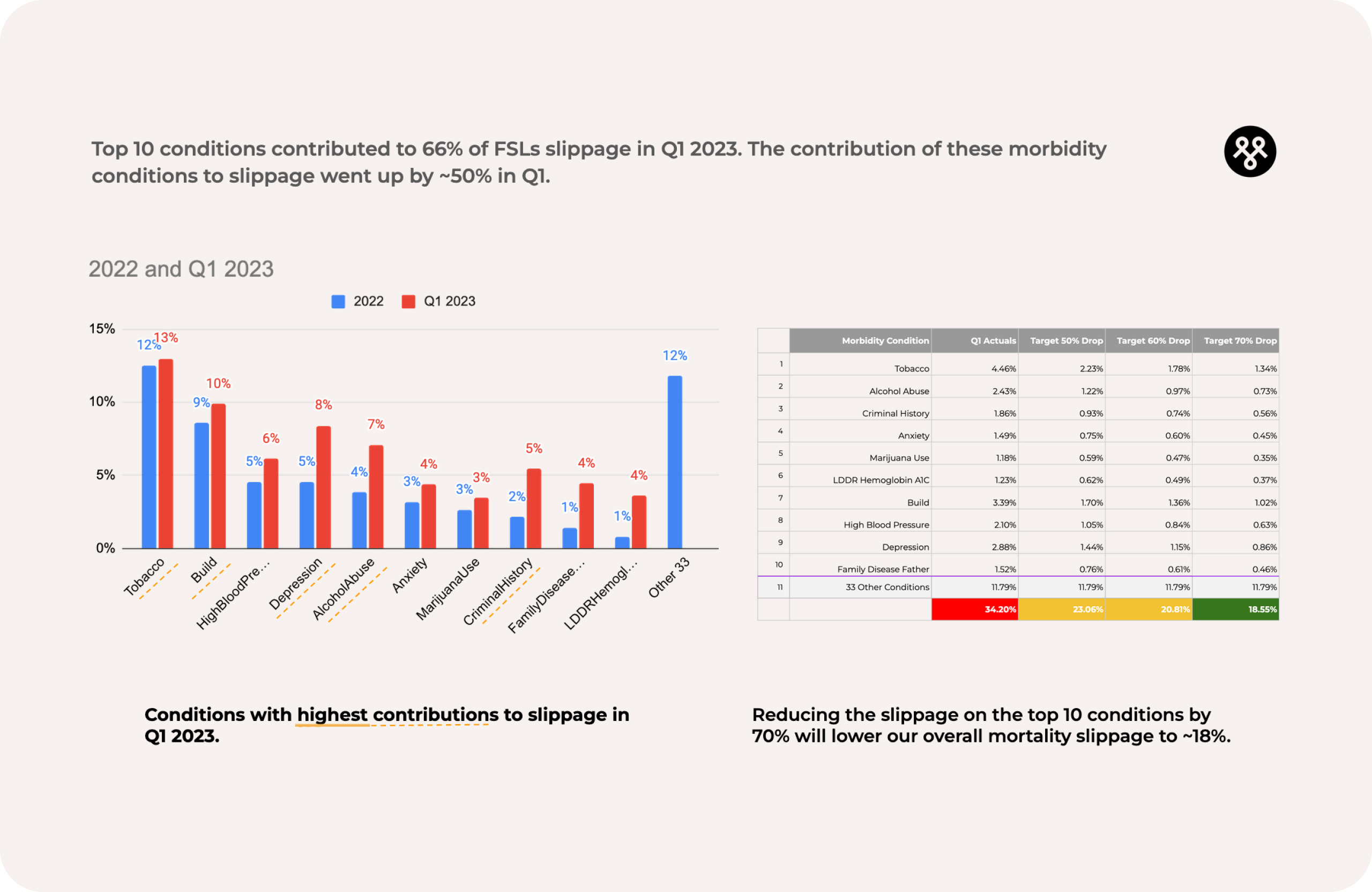

Data science and underwriting flagged that post-issue slippage-differences between automated and human underwriting-rose to 33% in Q1 2023, far above our 18.5% target. Ten conditions accounted for 66% of slippage, with a ~50% rise in impact over the quarter.

This made it clear the issue wasn't broad-it was concentrated. And the largest driver was tobacco and nicotine usage.

Goal-Oriented Research

To understand why applicants were misreporting, I conducted targeted research with underwriting, data science, and a content designer.

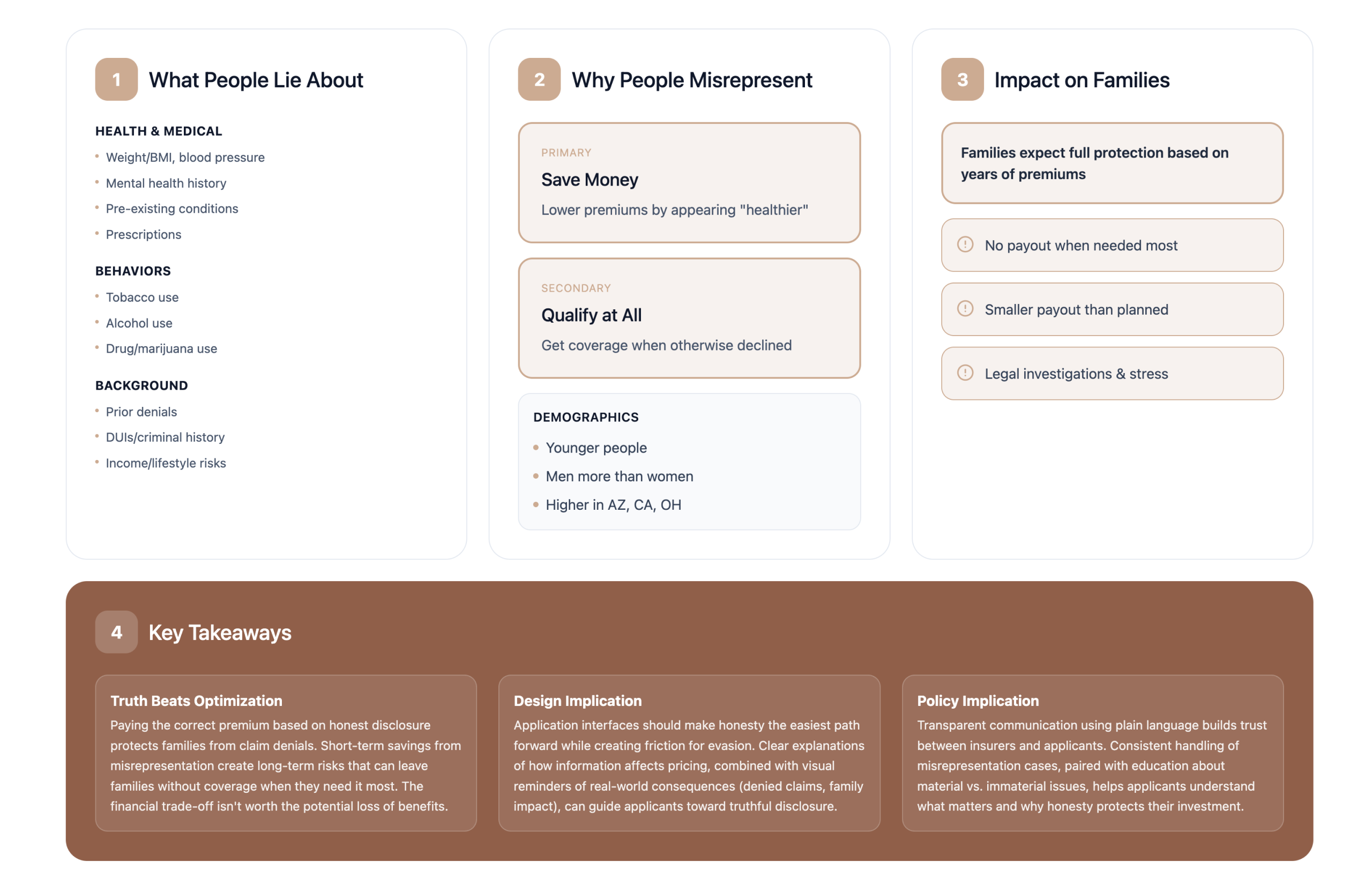

What we uncovered

- Misrepresentation overwhelmingly came from confusion, not fraud.

- Applicants were unsure how precise their answers should be or how to interpret certain conditions.

- A small minority knowingly "took their chances," assuming details might not be verified.

- Stricter validation would increase abandonment without improving truthfulness.

How this shaped our approach

We shifted from "add more guardrails" to improve clarity, structure, tone, and contextual guidance-especially around sensitive conditions. This allowed us to influence truthful reporting without adding friction.

Scoping the Opportunity

With root causes identified, we mapped opportunities across three pods: rules refinement, model optimization, and our pod-improving disclosability.

We prioritized the top 10 slippage-driving conditions using:

- Underwriting impact

- Confusion likelihood

- Misreporting frequency

- Implementation effort

For sensitivity reasons, this case study focuses on the highest-impact category: tobacco and nicotine usage.

Phase 2 - Create

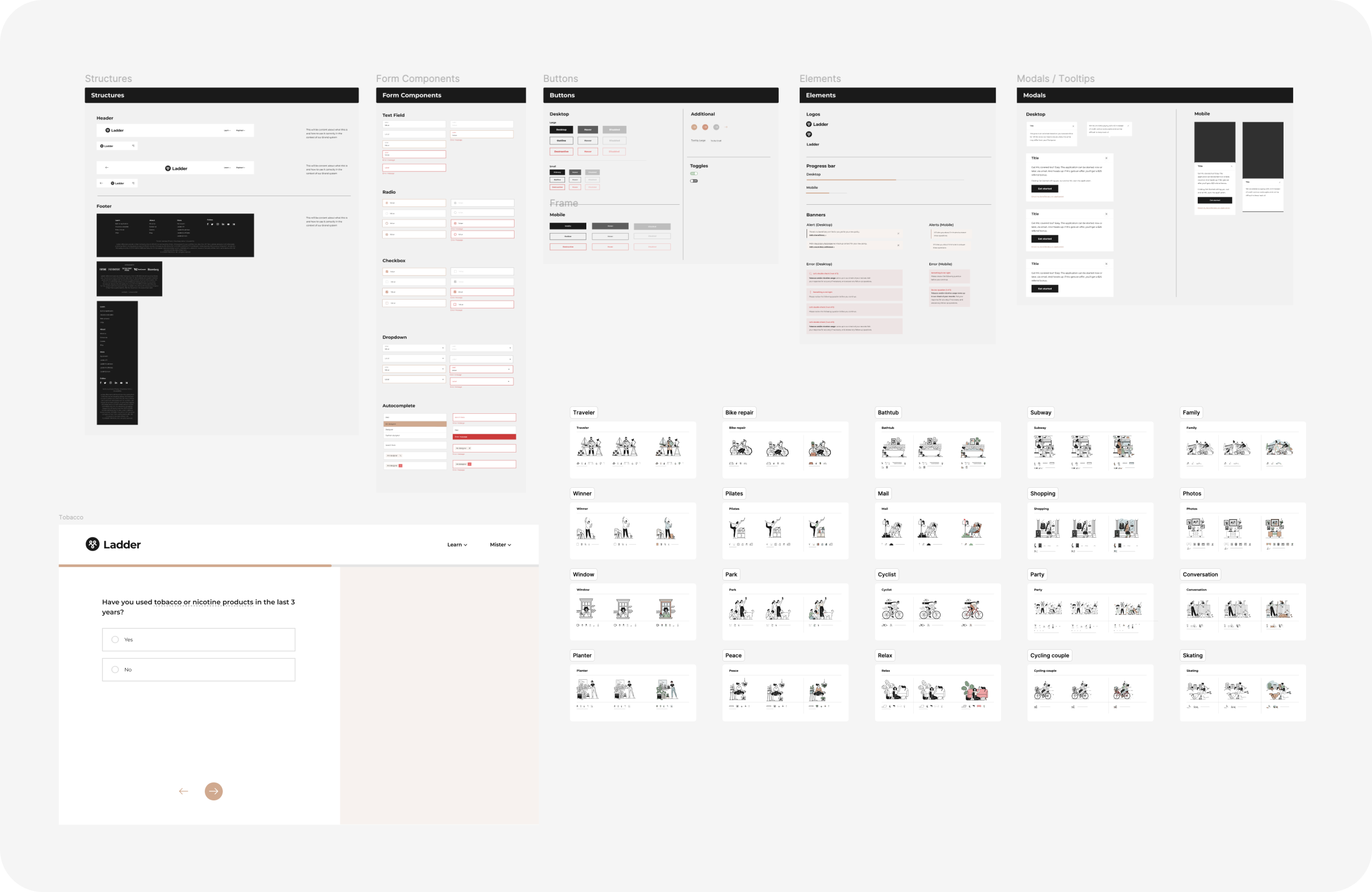

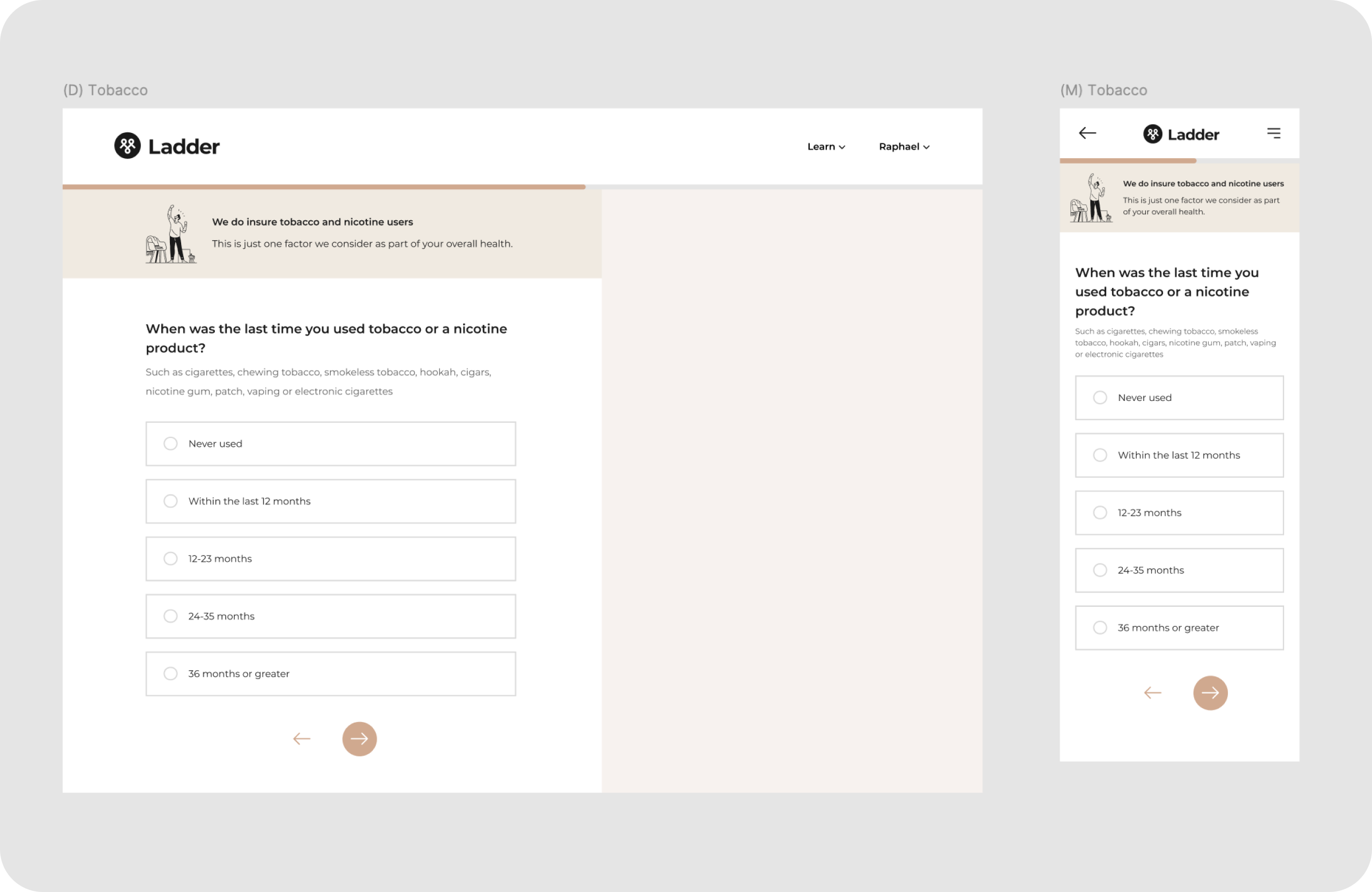

Evaluating the Existing Toolbox

Because of regulatory and timeline constraints, introducing new UI components wasn't feasible. Instead, I audited our existing patterns-inputs, validation rules, and content behaviors-to identify where clarity could be improved without adding friction.

Key insights:

- The primary issue wasn't rules-it was lack of clarity.

- The absence of relatable examples and supportive guidance created anxiety rather than trust.

Working closely with a content designer, we reframed microcopy, structured contextual guidance, and repurposed existing illustrations to make disclosures feel clear, supported, and judgment-free.

This approach laid the foundation for a more trustworthy and intuitive disclosure experience-without introducing new components or regulatory risk.

Proposed Solutions

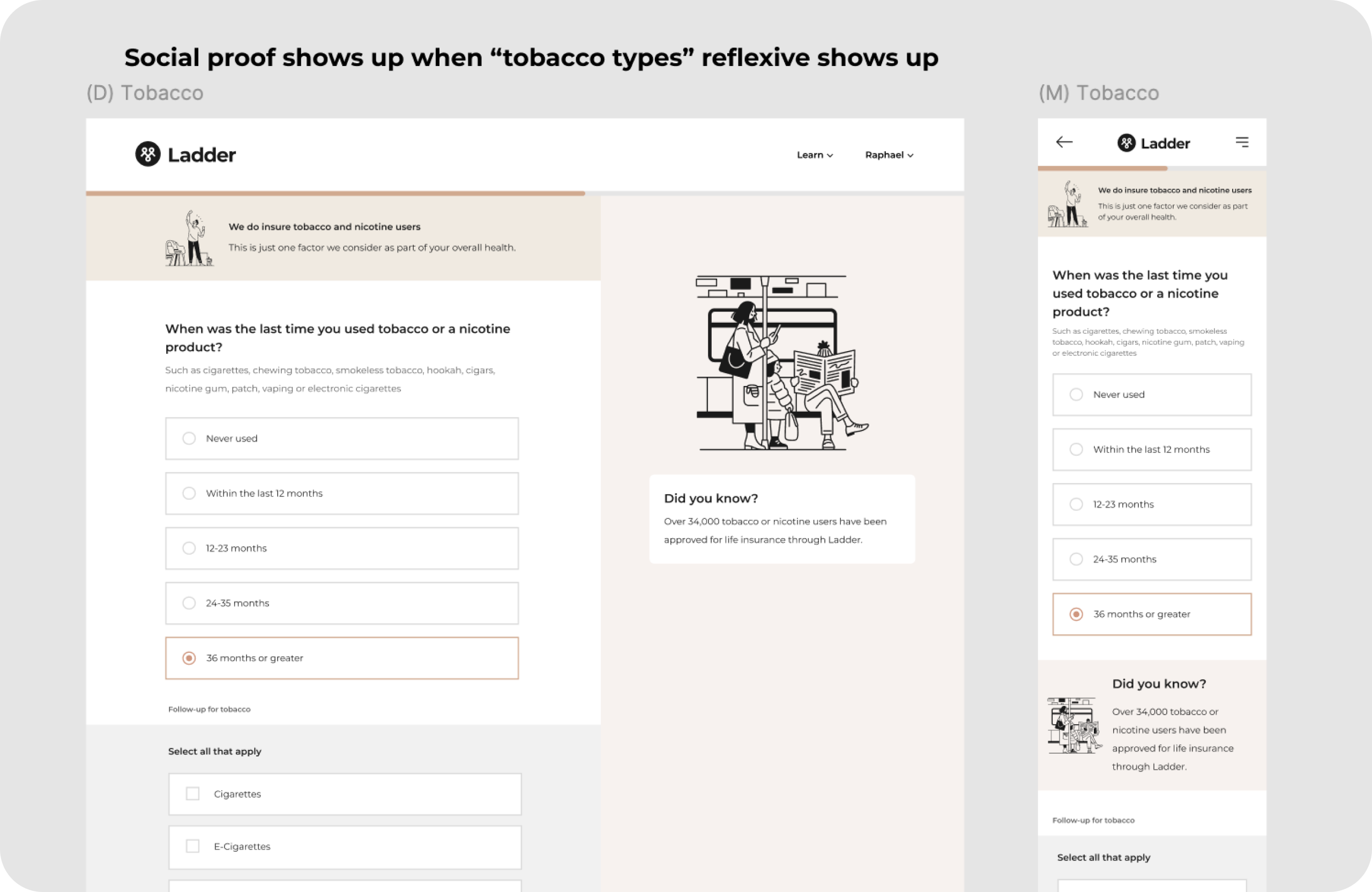

Guided by research insights, I designed solutions that increased clarity and transparency without slowing applicants down:

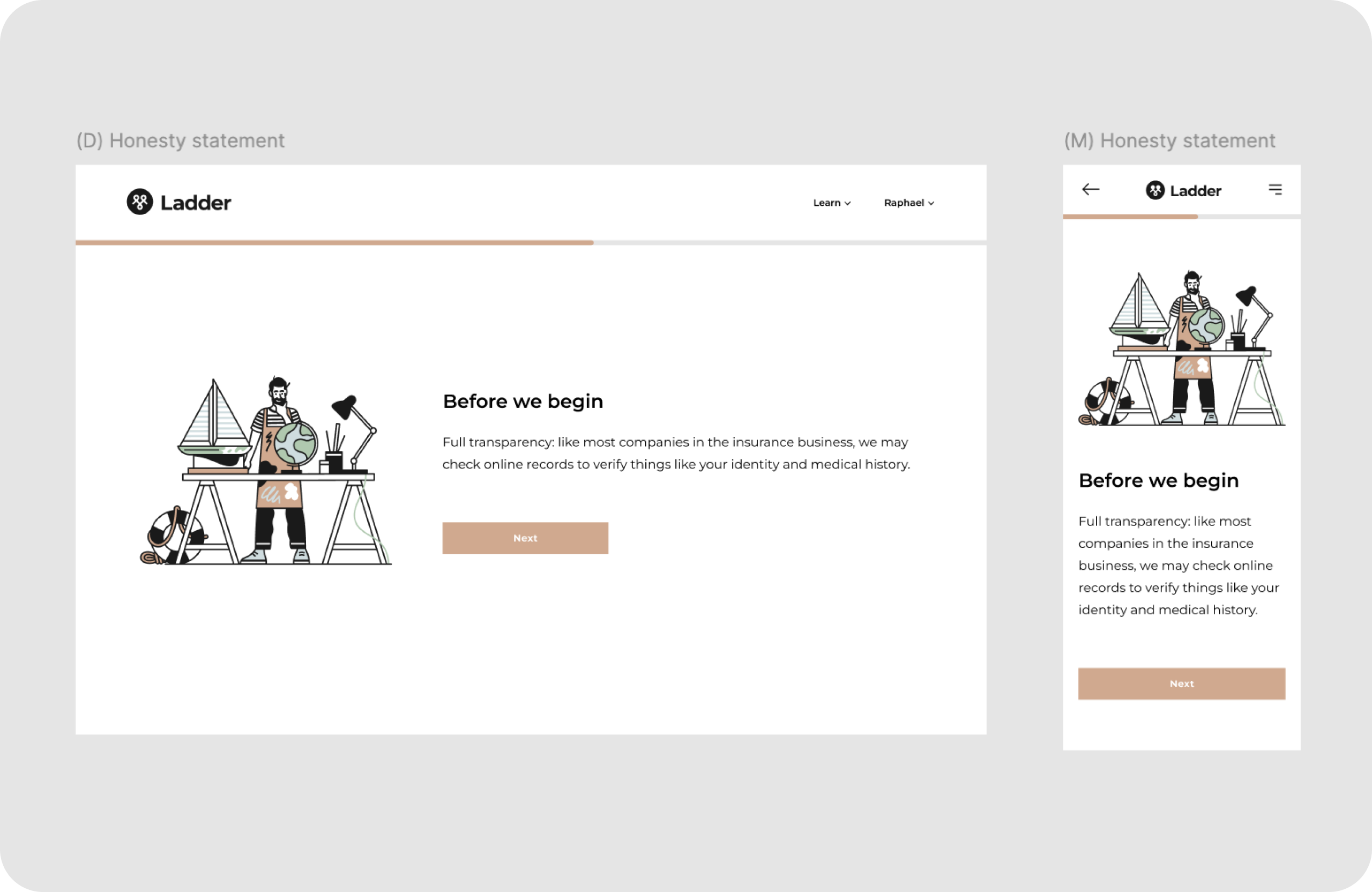

1. Honesty Statement

Set expectations upfront using empathetic, non-punitive language to normalize truthful reporting.

2. Transparent Data Practices

Explained what data we verify and why-deterring intentional misreporting without creating fear or friction.

3. Encouraging, supportive examples

Placed contextual examples above inputs, written in a warm tone (e.g., reinforcing that smokers are eligible).

This reduced fear of penalty and made applicants more comfortable reporting truthfully.

Together, these changes aligned applicants with the correct risk class earlier, reducing slippage and downstream manual review.

Experimentation

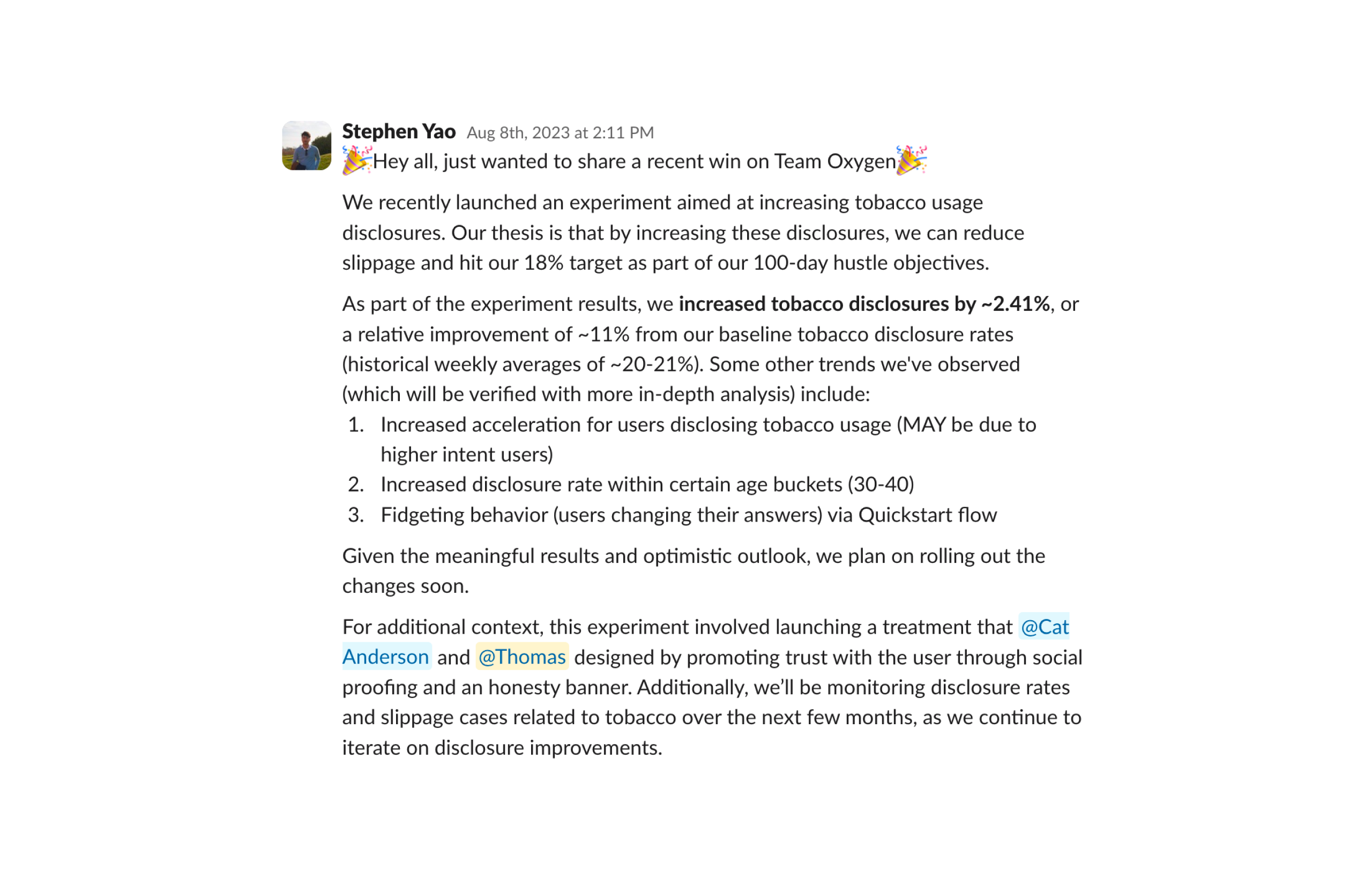

We validated the new patterns through A/B testing:

- The honesty statement and social-proof treatments increased tobacco and nicotine disclosure by 11.7% relative lift.

- No negative impact on conversion, despite the sensitivity of the category.

This confirmed that clarity and encouragement-not friction-drive truthfulness.

Phase 4 - Reflect

True Impact

By Q3 2023, the initiative produced strong, measurable business and user outcomes:

- +9% improvement in substance disclosures

- +12.9% improvement in answer accuracy on the review page

- +10.5% increase in policies issued

- Slippage reduced to 15.3%, beating our 18.6% target

These outcomes confirmed the broader insight:

Clear, supportive design increases truthfulness, which reduces slippage and improves long-term risk accuracy.

This strengthens profitability, aligns applicants with the correct risk class, and reduces exposure for reinsurers.

Reflection & Key Learnings

This was one of the most challenging and rewarding projects I've led. Designing in a regulated environment forced me to think more strategically, balance creativity with constraints, and align multiple functions around a sensitive problem.

Key learnings:

- Driving clarity in ambiguous spaces requires deep partnership with domain experts-underwriting, data science, and compliance.

- Advocating for user trust in risk-sensitive flows means designing for truthfulness, not just compliance.

- Delivering solutions that are both user-centric and operationally sound requires balancing empathy with business impact.

It significantly increased leadership confidence in my judgment and elevated the way I approach high-impact, cross-functional challenges.

Next Steps

I rolled off the team in Q4 2023 due to a company reorg, and a strong successor has since taken over. I continue to support as an advisor when needed.

While NDAs prevent me from sharing details, the team is building on this foundation with new innovations that will take the experience-and accuracy-even further.