Enabling Agent-Assisted Applications for Ladder

Unlocking a scalable IMO channel through agent control, faster closes, and higher-quality conversion.

I designed Ladder's first agent-assisted application experience to unlock IMO distribution, enabling agents to start applications and seamlessly pass them to clients for review and submission. This closed a critical gap where agents had no control or visibility after sharing a quote, transforming how Ladder works with IMO partners. The solution achieved 26.9% end-to-end conversion, meaning roughly 1 in 4 agent-assisted clients bind a policy, and established a reliable, month-over-month revenue stream that scales with partner growth.

Introduction

Agents remain central to how most people purchase life insurance, and are critical to Ladder's long-term growth strategy.

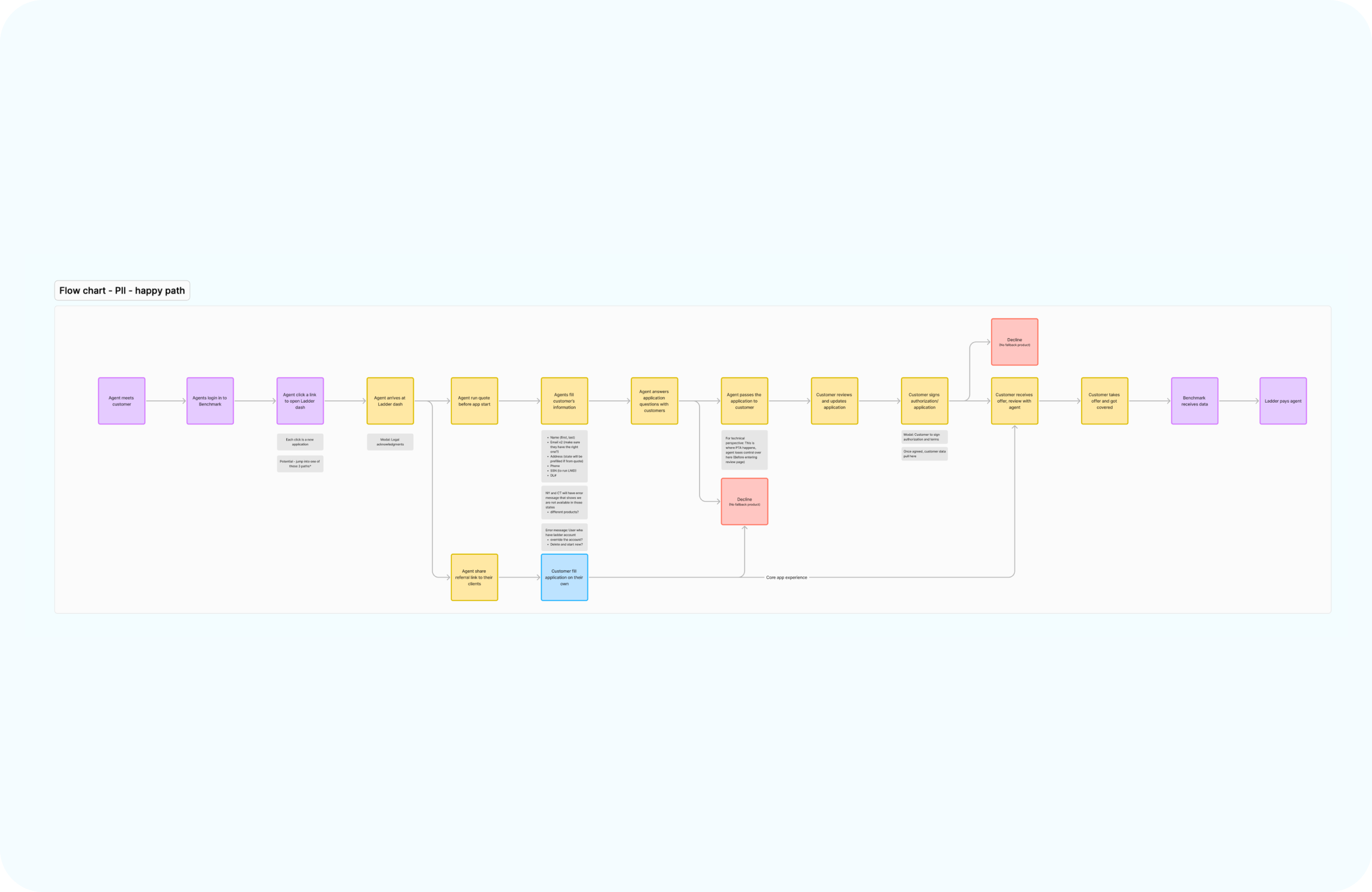

Prosperity, a life insurance carrier, partnered with Ladder to distribute Prosperity-backed term products through their IMO channel, with Ladder serving as the front-facing application experience for agents and clients.

I led the design of Ladder's agent-assisted experience, enabling IMO distribution through agent-led applications and pass-the-application flows that allow clients to review and submit with confidence.

This case study focuses on the agent-assisted application flow, the core unlock for scaling Ladder through the IMO channel.

The Problem

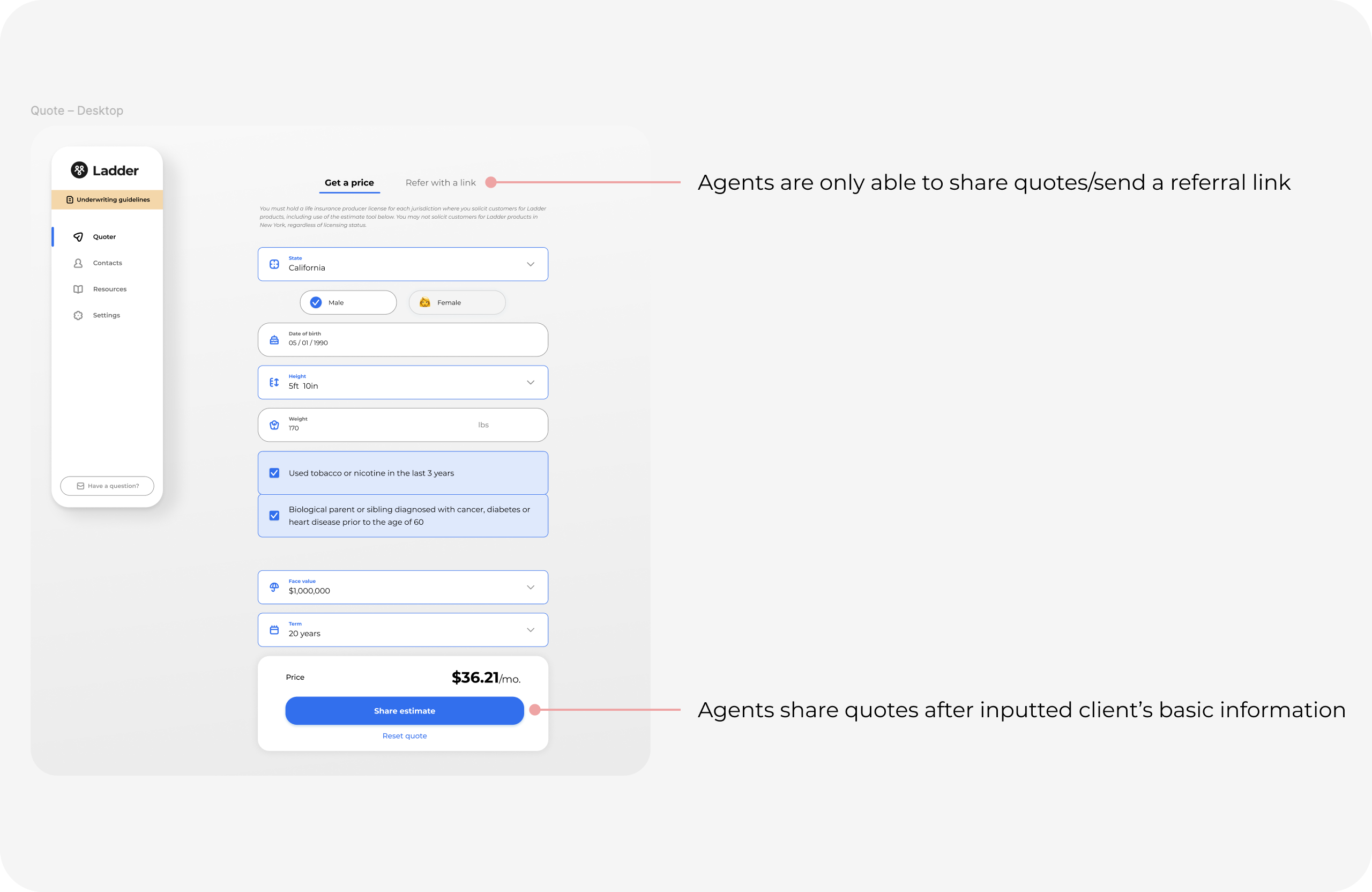

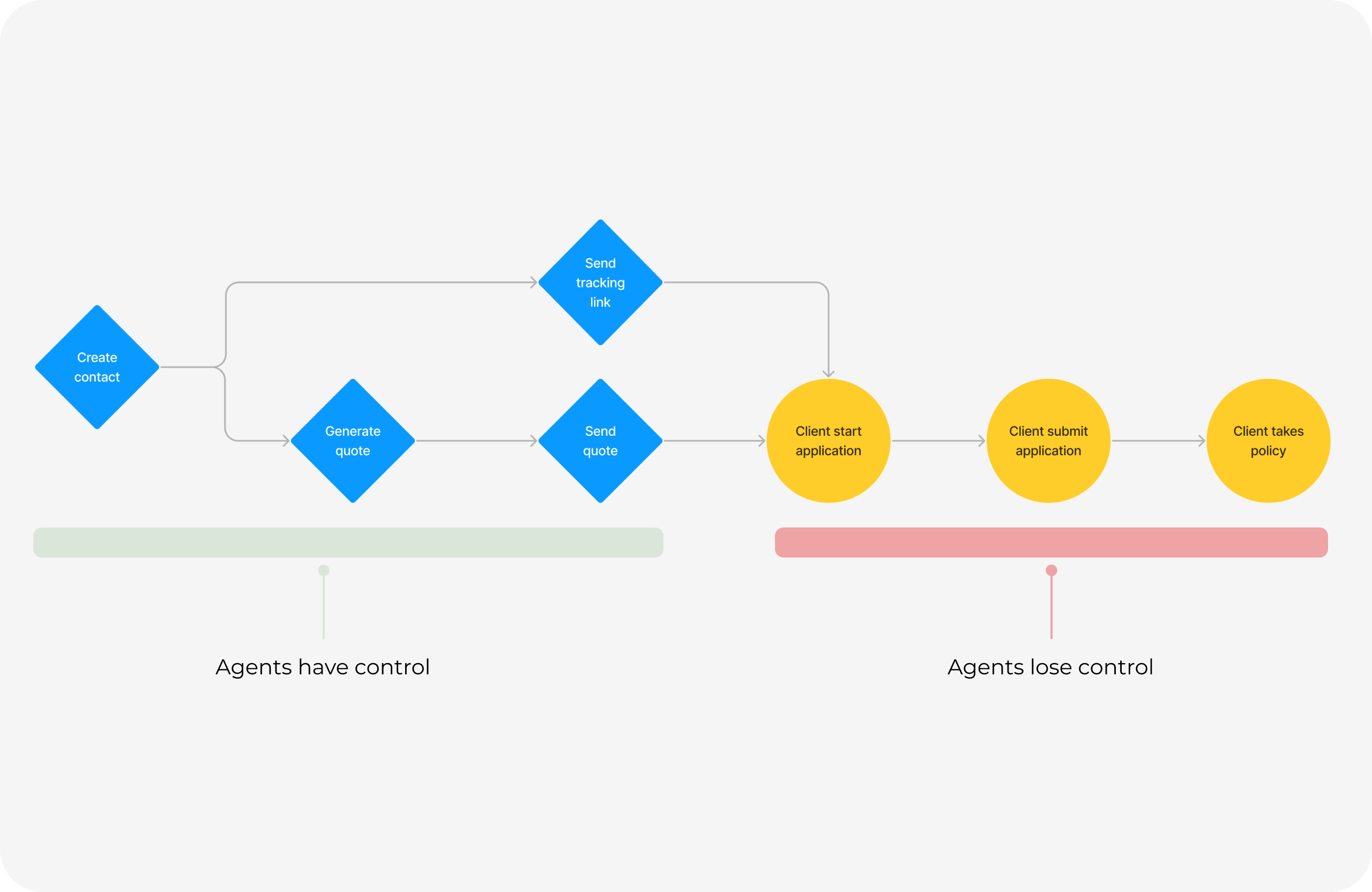

At the time, Ladder only supported referrals and quote sharing for agents.

Once a quote was shared:

- Agents had no control over what happened next

- No visibility into client progress

- No ability to guide, clarify, or close in the moment

- No way to ensure high intent or premium realization

For IMO agents, who are accustomed to closing policies live, this was a deal-breaker.

Agents told us plainly:

"If I can't walk my client through the application, I lose the sale."

Phase 1 - Study & Research

Research & Discovery

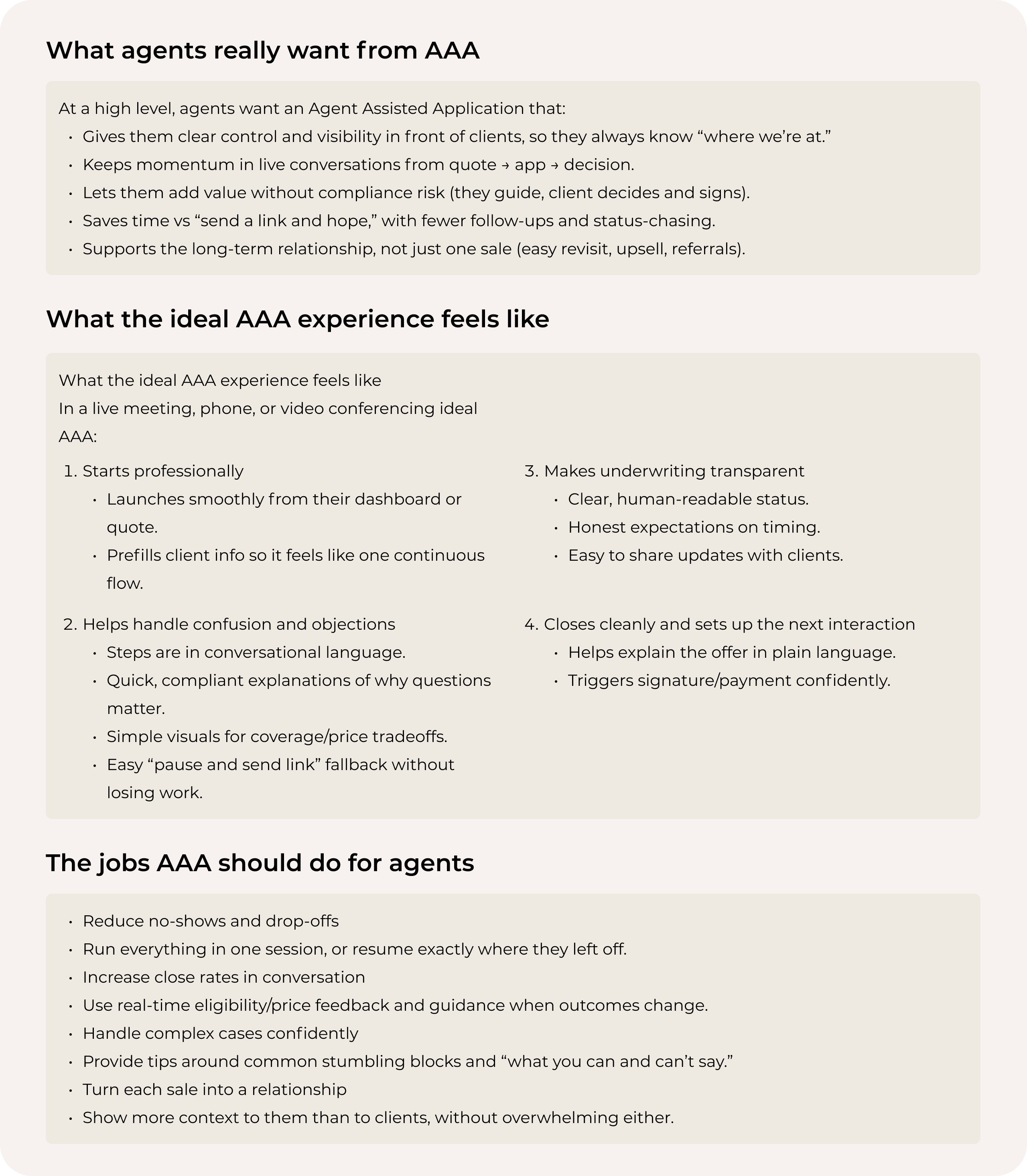

To validate the opportunity, I spoke directly with multiple agents across the IMO spectrum.

What we learned

- Some agents appreciated the simplicity of sharing a link

- Many strongly preferred completing the application with their clients

- Agent-assisted flows:

- Ensure higher intent

- Increase confidence at decision points

- Significantly improve bind rates

- Agents saw presence as the difference between a quote and a close

This confirmed that Ladder needed to support both autonomy and control, not just referrals.

Scoping the Opportunity

Rather than treating this as a feature, we framed it as a new distribution capability:

- Unlock IMO-scale growth without building a full agent portal

- Improve bind rates by supporting high-intent, guided applications

- Create a repeatable pattern for future agent partnerships

- Generate a sustainable, recurring revenue channel

The goal wasn't just to help agents. It was to materially improve conversion quality and premium realization.

Phase 2 - Create

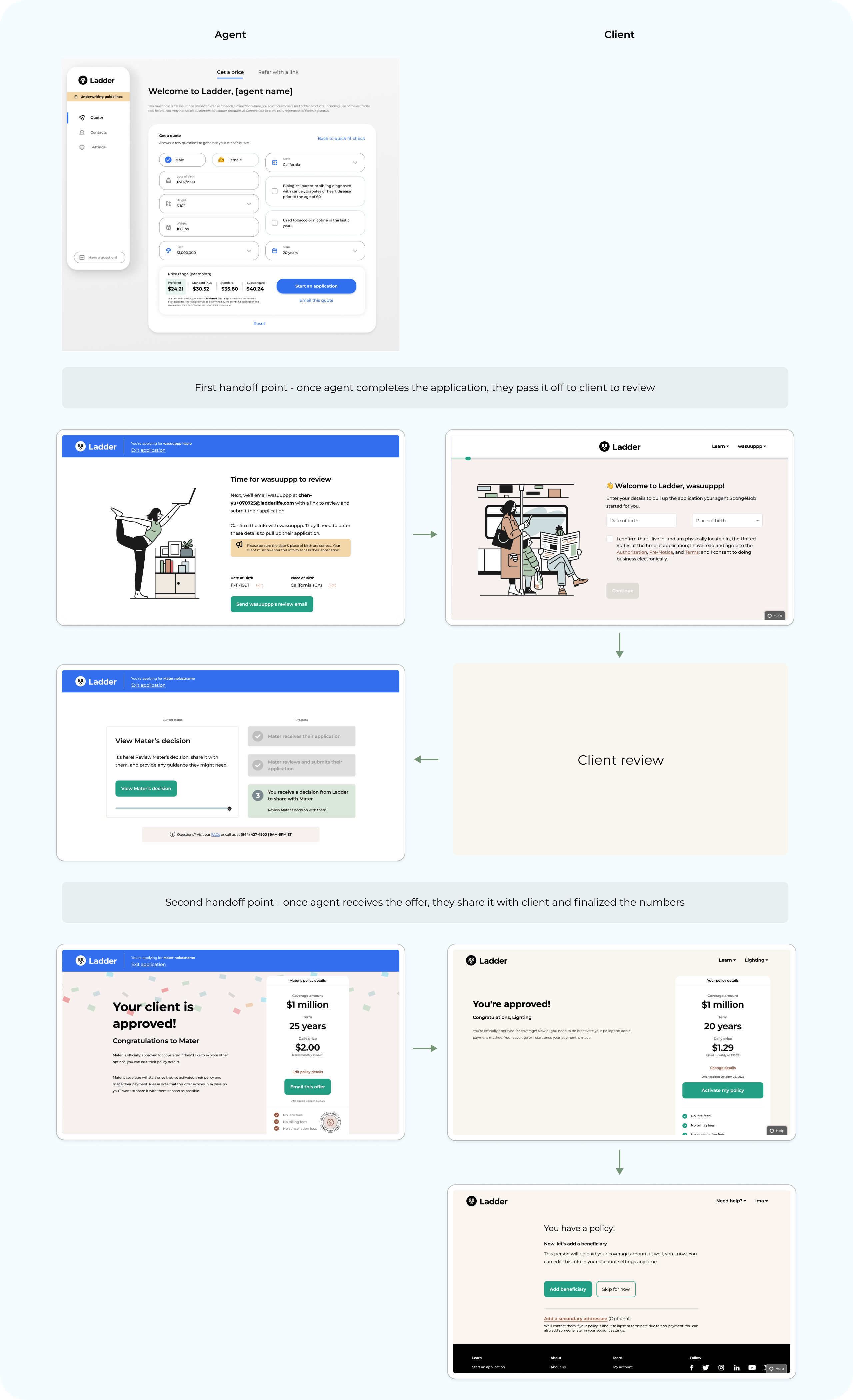

Pass-the-Application Flow

I designed a flexible application model that lets agents:

- Start the application with their client

- Complete high-friction or high-context questions together

- Pass the application to the client for review

- Allow the client to submit confidently, without rework

This balanced agent control with client ownership, reducing drop-off while preserving trust.

Key Design Principles

- Agent presence at high-stakes moments

(health questions, coverage decisions, pricing clarity) - No duplicate effort

Clients never re-enter information already completed with an agent - Clear handoff

Clients understand what the agent completed vs. what they're confirming - Fast time to value

Designed to close policies in-session when possible

Phase 3 - Learn & Impact

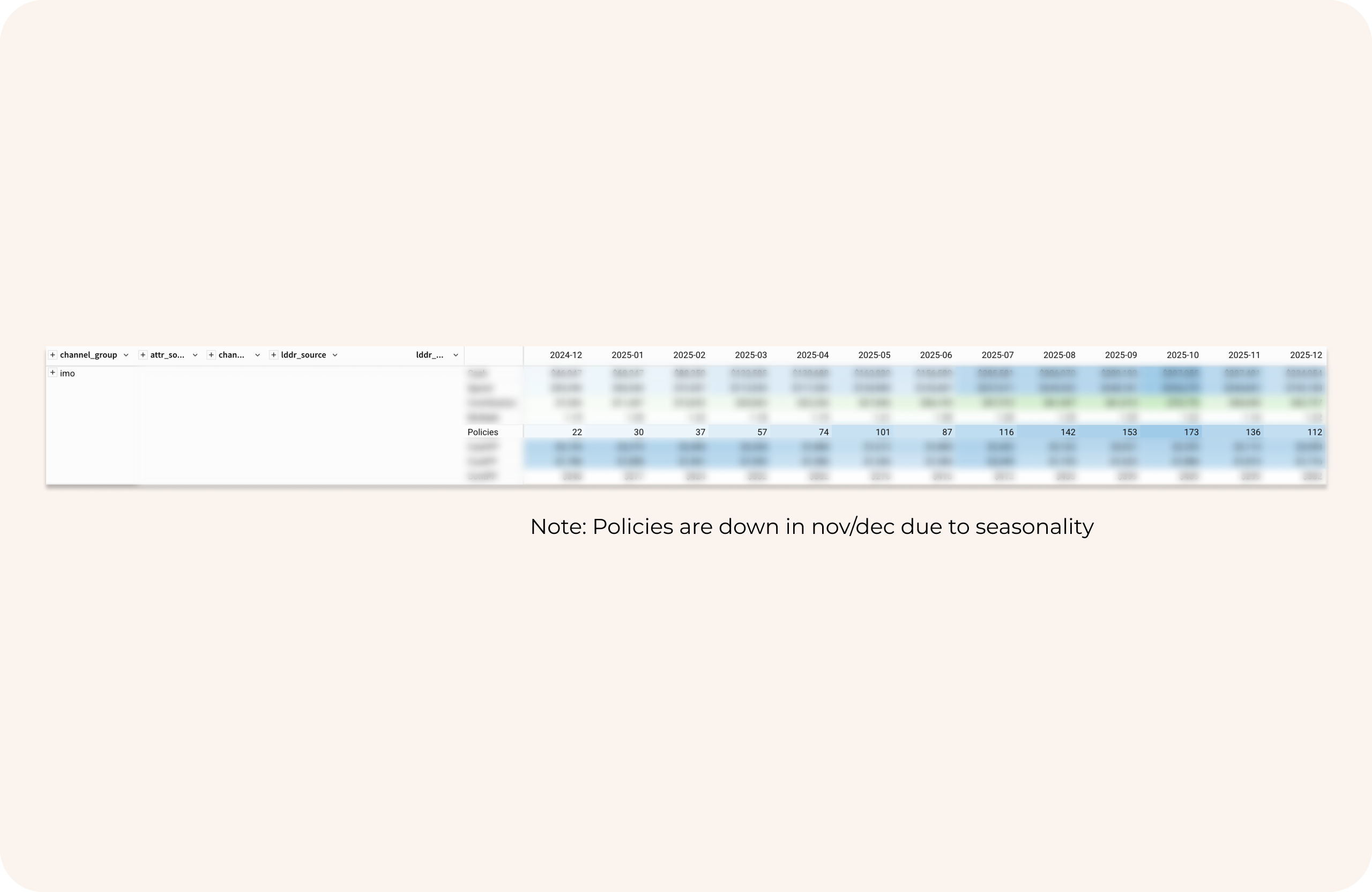

Post-launch performance confirmed the strategy:

- 26.9% end-to-end conversion

→ Roughly 1 in 4 agent-assisted clients bind a policy - 65% offer rate

→ With agent guidance, clients are far more likely to qualify successfully - Strong month-over-month growth

→ The IMO channel became a regular, dependable revenue stream

This wasn't just additive volume. It was higher-quality conversion with stronger premium realization.

Reflection & Key Learnings

This project challenged my assumptions about what "good design" means in different contexts. Coming from a D2C background, I initially thought agents would want the same simplicity we built for direct consumers. But agents needed control at the moment of truth, not just a link to share. When they said "if I can't walk my client through this, I lose the sale," that wasn't feedback on a feature. It was feedback on our entire distribution strategy.

Key learnings:

- Distribution goes beyond a channel - it's a fundamental product constraint.

- No amount of optimization can replace understanding how your users actually work.

- The most effective designs align incentives, not just interfaces.

The 26.9% conversion rate validated that approach, but more importantly, it showed that designing for how people actually work unlocks new possibilities.

Next Steps

I'm now extending agent-assisted applications to more products and partners, using this model as a standard for IMO distribution. We're bringing API-driven underwriting into agent flows to enable faster decisions and higher-quality conversion, while leveraging this success to onboard new IMO partners and scale distribution efficiently.

This work laid the foundation for a scalable, multi-partner agent strategy that supports long-term growth without added user friction. By positioning agent enablement as a core growth lever while preserving Ladder's simple D2C experience, we're building a distribution model that works for both agents and direct consumers.