Introducing Prudential API into Ladder

Expanding coverage through accurate product matching and a seamless partner experience.

I replaced a confusing off-site redirect with a fully integrated, API-driven Prudential flow inside Ladder. By designing a seamless, native integration that improved trust and reduced friction, I created a scalable multi-carrier design pattern that increased conversion. The integration helped Ladder hit Prudential's 3,500-policy target early and unlocked higher compensation tiers-proving that thoughtful UX design can directly accelerate revenue growth.

Introduction

Leadership tasked me with expanding Ladder's third-party distribution capabilities, starting with Prudential-one of our highest-value partners. With Prudential's new underwriting API, we had an opportunity to replace a disjointed redirect flow with a native, transparent, decision-ready experience inside Ladder.

This case study covers how I led the product design, strategy, cross-functional alignment, and UX integration for Ladder's first embedded partner product-improving product matching, strengthening trust, and unlocking meaningful revenue growth.

The Challenge

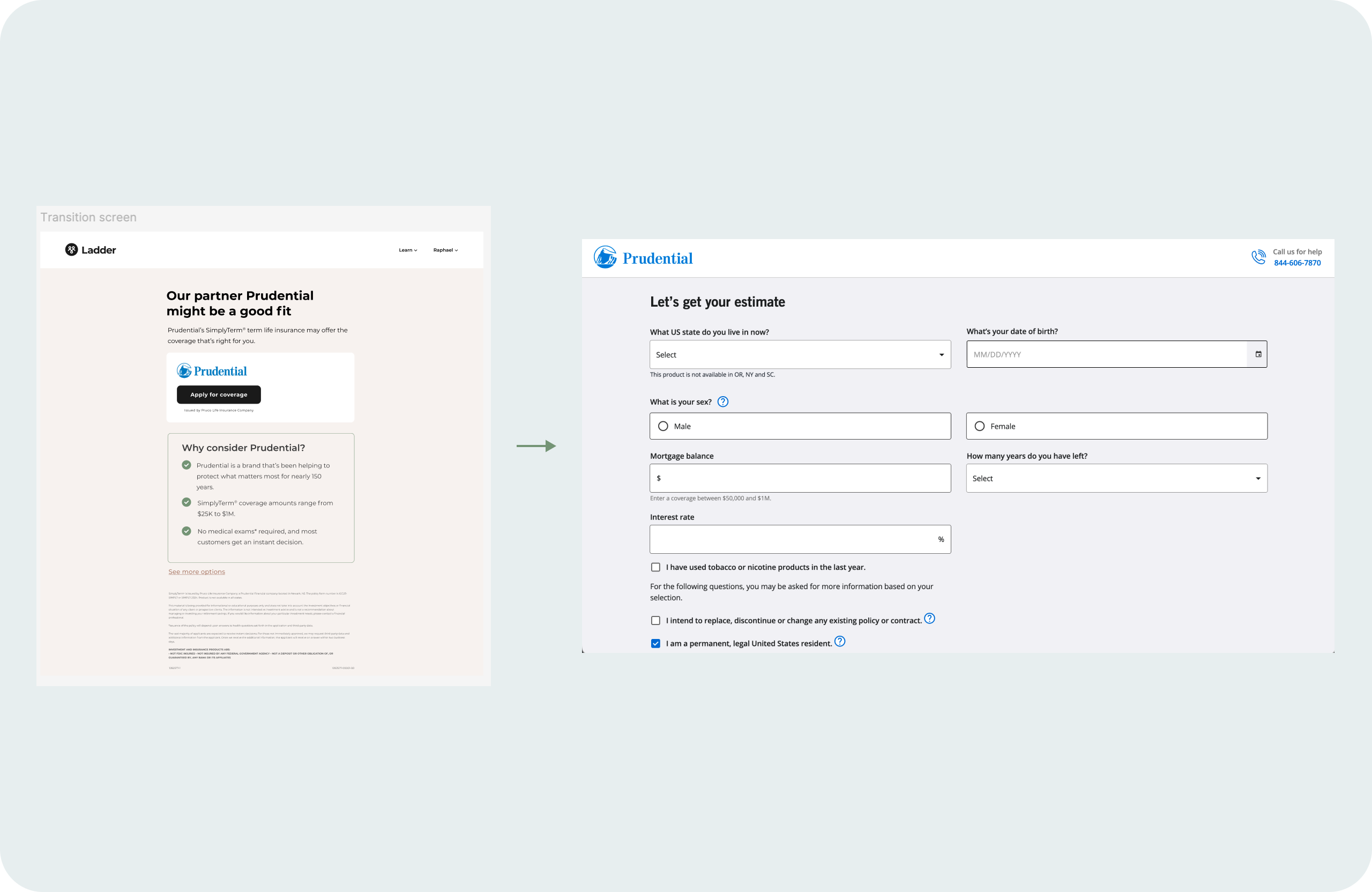

- Users were being redirected off-site mid-application without context, creating confusion and distrust.

- The experience required users to re-enter information, causing frustration and duplicated effort.

- This was Ladder's first 0→1 API partner integration, with no existing patterns or infrastructure to build from.

- We needed a seamless, transparent, scalable experience that could support future multi-carrier expansion.

My Role

I led research synthesis, UX strategy, interaction design, cross-company alignment, prototyping, and the creation of reusable design patterns for future integrations.

Phase 1 - Study & Research

Identifying the Problem

Redirecting users to Prudential's external site-after they had already completed part of Ladder's flow-caused:

- Trust loss: sudden redirect ≈ scam-like

- Redundant effort: users repeated questions they already answered

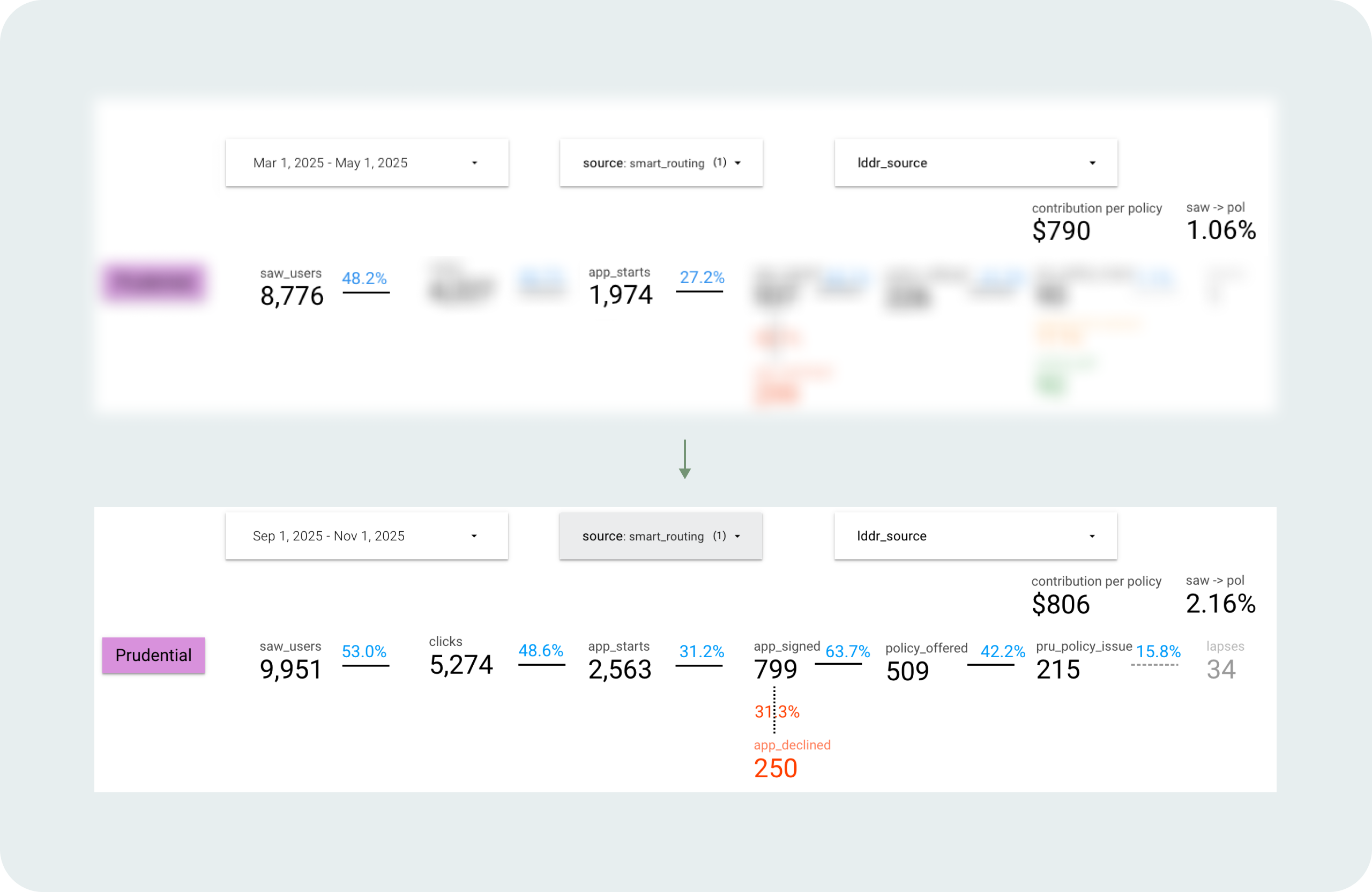

- Low performance: a 1.1% conversion rate

Together this highlighted the need for a continuous, predictable, native-feeling partner experience.

Mid-application redirect to Prudential's external site caused confusion and significant dropoff.

Research & Discovery

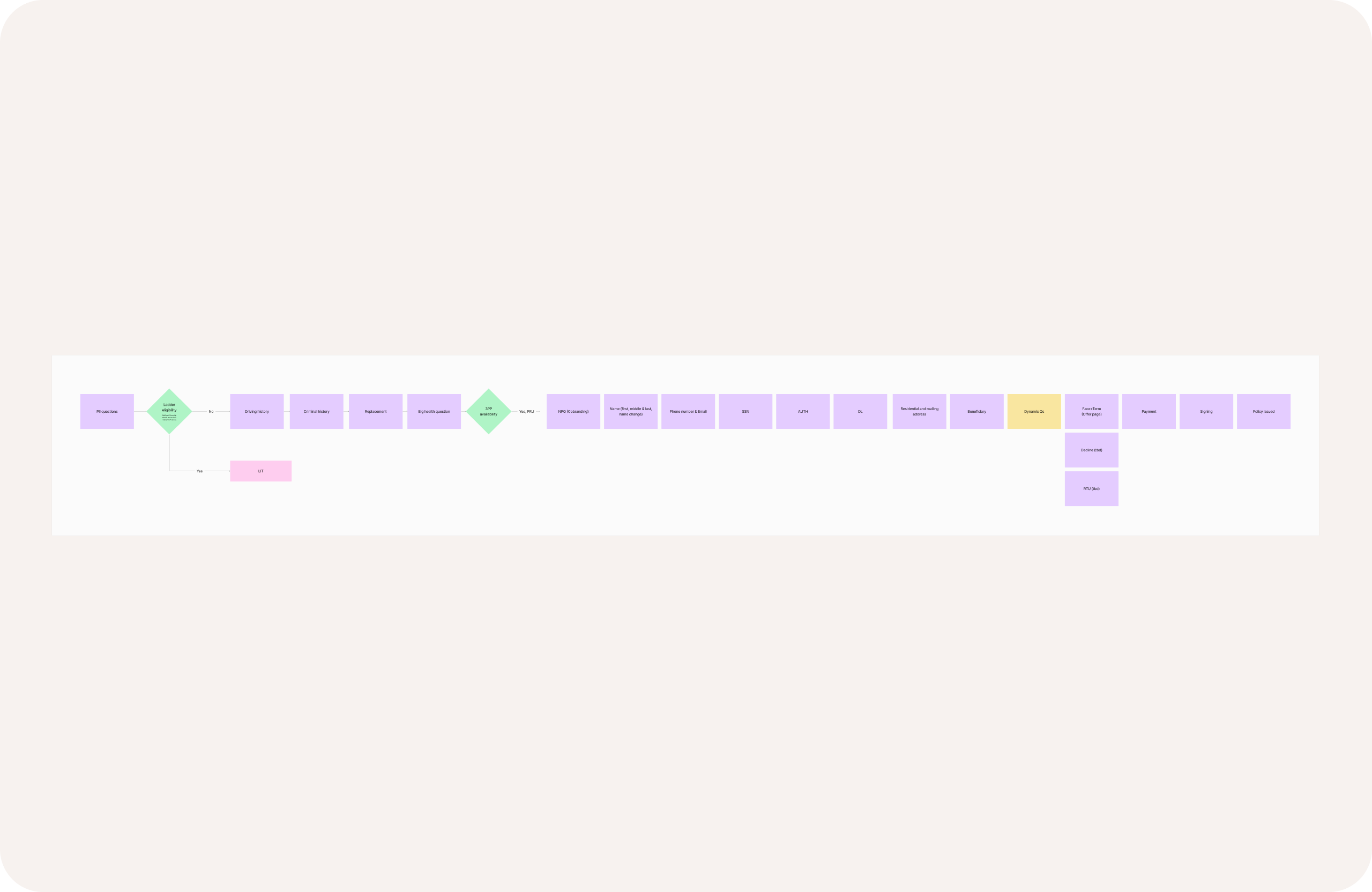

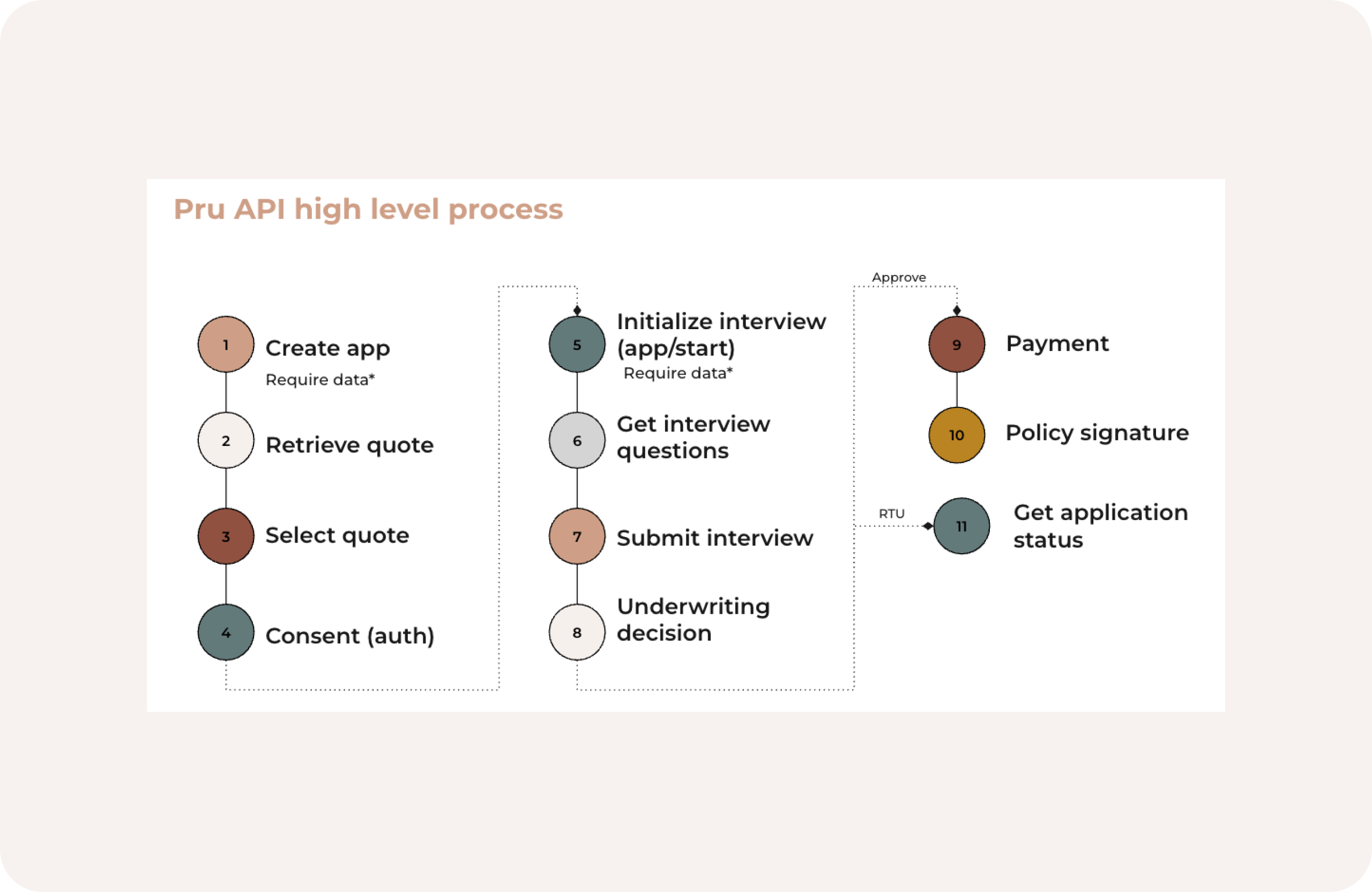

I partnered closely with Prudential's product and underwriting teams to understand their API and data requirements, conducted user interviews to pinpoint trust failures, and audited multi-carrier industry patterns.

I synthesized these findings into a clear product direction shared across Ladder and Prudential-aligning both teams on the experience, scope, and success metrics.

Scoping the Opportunity

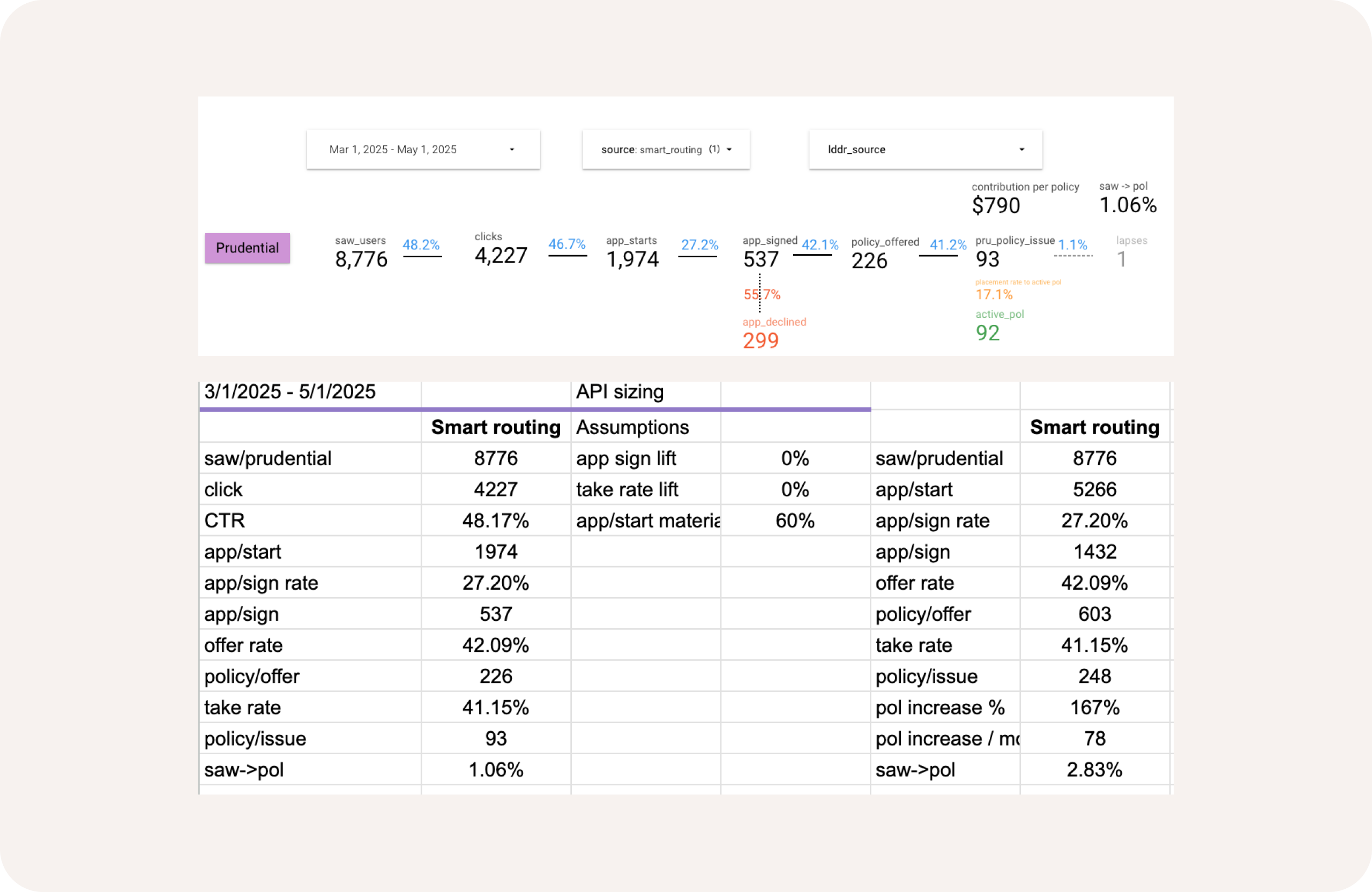

Data modeling showed that embedding Prudential (instead of redirecting) would eliminate a major drop-off and drive a 167% increase in monthly policies (≈78 additional) at a conservative 60% materialization rate.

Additionally, Prudential's decision API unlocked, for the first time, the ability to serve alternative products when users were declined-laying the groundwork for a future multi-carrier system.

Phase 2 - Create

Designing the MVP Integration

We targeted Smart Routing-the moment after onboarding questions and before entering the application-because of its high 25.2% saw → app/start leverage.

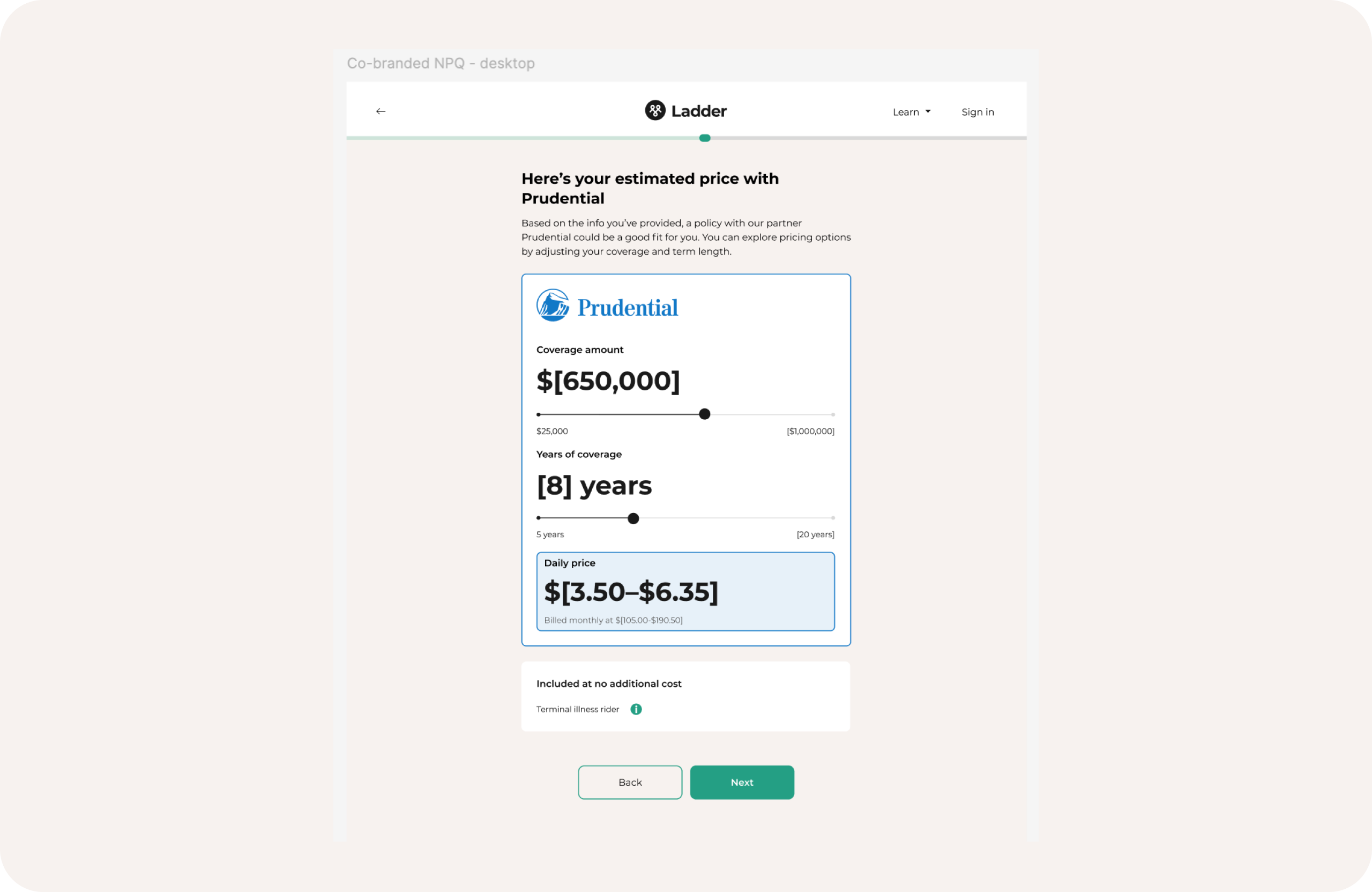

1. Setting Clear Expectations on the Quote Page

To reduce cognitive load and avoid visual clutter, I transformed this section into concise, scannable elements:

- Prudential branding embedded directly into the quote

- Clear explanation of why the Prudential product is being shown

- Callouts of included Prudential value (e.g., riders, coverage structure)

- Transparent expectations of what happens next

This mitigated the "Why am I seeing this?" confusion and made the partner recommendation feel intentional.

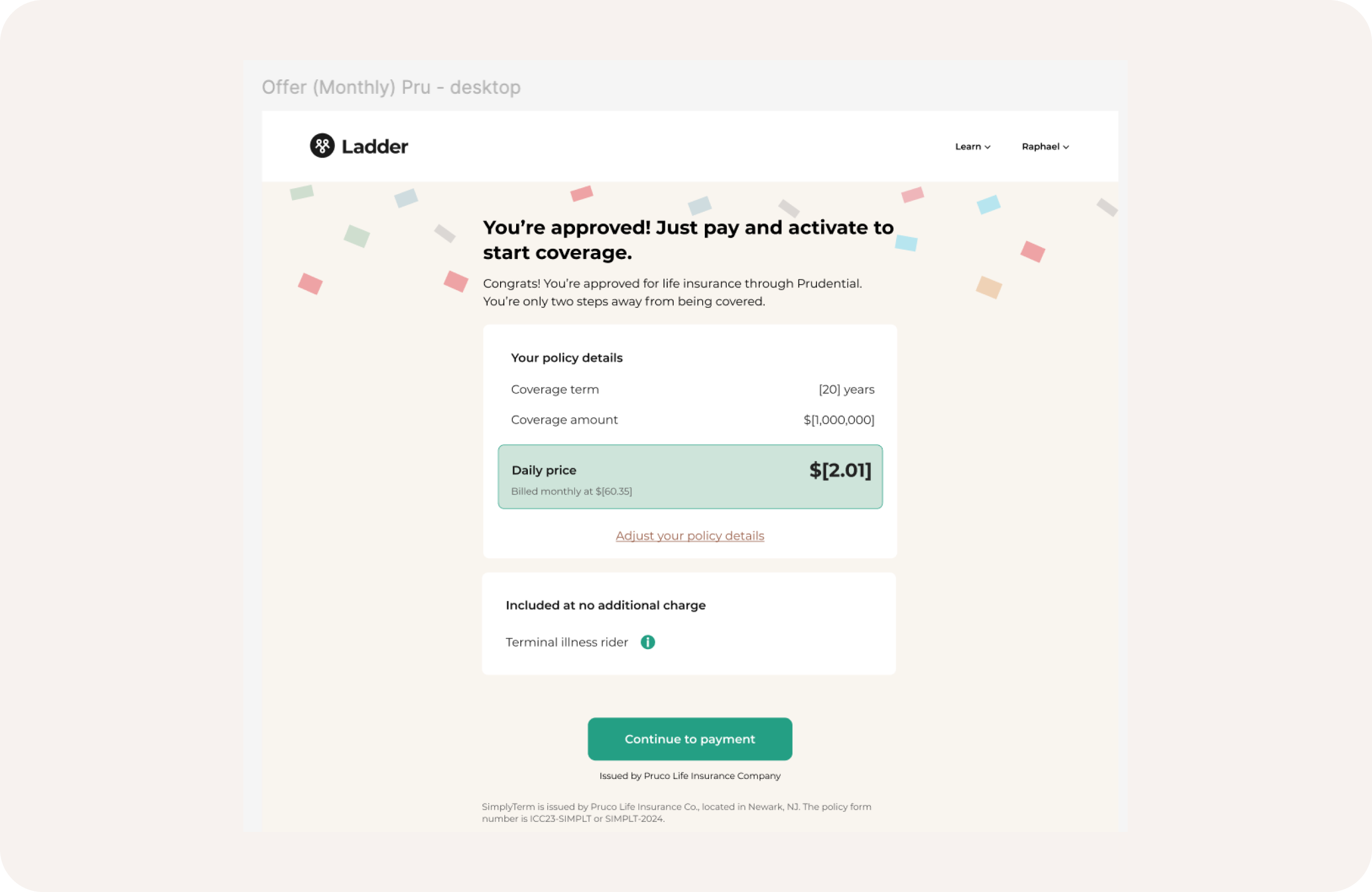

2. Enabling Instant Underwriting Decisions

Through deep collaboration with engineering, BD, and Prudential's API team, we:

- Passed all relevant Ladder application data directly into Prudential's underwriting API

- Removed all duplicated question sets

- Triggered instant decisioning

- Delivered a native offer inside Ladder without extra user effort

This turned a clunky redirect into a seamless, trusted, embedded experience.

Phase 3 - Learn & Impact

Early results from the first 2 months showed the integration was solving core user issues:

- +4% lift in saw → app/start

- +1.1% increase in overall conversion

- Fewer CX tickets, significantly reducing confusion-related support

- Lower internal underwriting cost, since Prudential handled qualified applicants

Overall validation:

A native, transparent partner flow increases trust, improves funnel performance, and strengthens unit economics.

Phase 4 - True Impact

This integration didn't just improve UX-it transformed Ladder's partner performance.

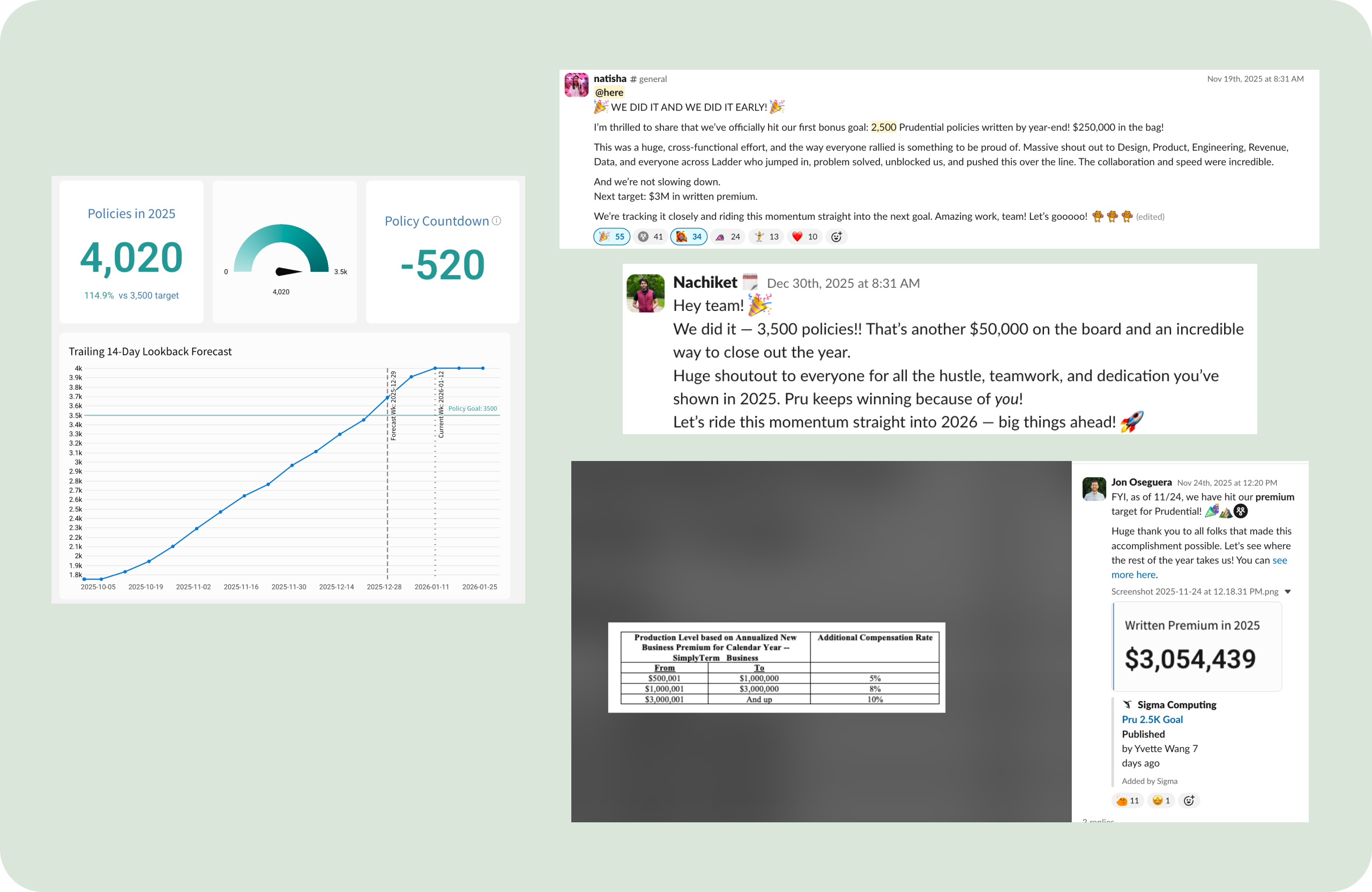

1. Hit Prudential's 3,500-Policy Goal Early

Prudential challenged Ladder:

Issue 3,500 policies by the end of 2025 in exchange for a $300k performance bonus.

With enhanced funnel efficiency from the API integration, Ladder hit the target with a month to spare-securing the full bonus.

2. Unlocked a Higher Compensation Tier (+2% Commission)

The flow also accelerated Ladder past $2M in written premium, triggering Prudential's next compensation tier-earning Ladder an additional +2% commission on every Prudential policy sold.

These two levers combined created a significant and recurring revenue lift.

Reflection & Key Learnings

This was the most ambiguous, cross-organizational project I've worked on. With Prudential simultaneously updating their application, I had to continually map evolving flows, maintain alignment across teams, and provide clarity in a shifting environment.

Key learnings:

- Deep communication is the backbone of ambiguous work.

- Visualizing complexity early aligns stakeholders faster than documentation alone.

- Design leadership goes beyond UX - it's orchestration, alignment, and clarity.

I'm grateful for the cross-functional team-content design, compliance, engineering, business development, and project management-whose collaboration made this project successful end to end.

Next Steps

I'm now extending the integration across other entry points in the funnel and introducing new UX patterns to optimize the partner experience. The plan is to replicate this success across future partner products-creating a scalable, high-trust multi-carrier platform.

This foundation will allow Ladder to confidently support new partner products in the future, accelerating growth while maintaining a best-in-class user experience.